As investors continue to closely monitor the movements of Nvidia Corporation (NASDAQ: NVDA), speculation regarding the possibility of a stock split in 2024 has become a topic of interest. In this article, we’ll delve into the factors influencing stock splits, analyze Nvidia’s historical behavior, and assess the likelihood of a stock split occurring in 2024.

The current status of Nvidia’s stock is quite remarkable. As of March 12, NVDA is trading at approximately $900 per share, marking a significant increase since the end of 2022.

Over the past 14 months, the stock has experienced an impressive surge, climbing nearly 500%. In the year 2024 alone, Nvidia has already seen an 82% increase in its stock value, despite a minor 5.6% dip on March 8. This performance positions Nvidia as one of the standout stocks of the year.

The driving force behind this exceptional momentum is Nvidia’s emergence as a prominent and profitable leader in the field of artificial intelligence (AI). In its latest earnings report, Nvidia revealed a remarkable 409% quarter-over-quarter sales growth for its Data Center division, which is responsible for its AI products.

This surge in growth propelled the quarterly revenue for the Data Center segment to an impressive $18.4 billion, surpassing even the high expectations set by analysts.

Investors have been particularly enthusiastic about the significant monetization potential of Nvidia’s AI offerings. This excitement led to a surge in NVDA share purchases from the latter half of February through early March.

However, there was a brief reversal in momentum on March 8, likely due to profit-taking activities. Additionally, some investors may have been unsettled by a report from a Citigroup analyst, which highlighted a slight decline in Nvidia’s market share in specific categories.

Nvidia’s Stock Split History

To anticipate Nvidia’s potential actions in 2024, examining its historical behavior regarding stock splits provides valuable insights. Historically, Nvidia has executed stock splits to manage its share price and enhance shareholder value.

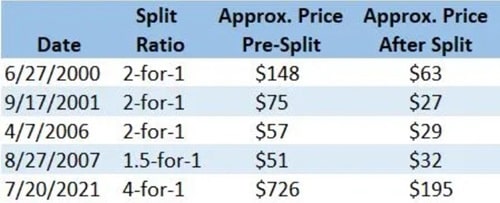

Nvidia has a notable history of stock splits, which underscores its strategic approach to managing its share structure and enhancing shareholder value. Over the years, Nvidia has executed several stock splits to adjust its share price and accommodate market demands.

One significant instance occurred in 2000 when Nvidia implemented a 2-for-1 stock split. This move effectively doubled the number of outstanding shares while halving the share price, making it more accessible to a broader range of investors.

In 2007, Nvidia embarked on another 2-for-1 stock split, further increasing the share count and reducing the share price. This decision aimed to enhance liquidity and attract more investors to the company’s stock.

A notable departure from the conventional 2-for-1 split occurred in 2016 when Nvidia announced a 3-for-2 stock split. This strategic move adjusted the share price to better align with market dynamics while maintaining the company’s market capitalization.

Through these stock splits, Nvidia has demonstrated its commitment to providing shareholders with opportunities for growth and investment. By adjusting its share structure, Nvidia aims to enhance liquidity, improve market accessibility, and potentially attract a broader investor base.

Overall, Nvidia’s stock split history reflects its proactive approach to managing shareholder value and adapting to changing market conditions. As investors continue to monitor Nvidia’s performance, past stock split decisions provide valuable insights into the company’s strategic priorities and long-term vision.

Potential Catalysts for a Nvidia Stock Split

Several factors play a significant role in determining the timing of Nvidia’s next stock split, including the share price, demand growth for AI, and accessibility concerns for the stock.

NVDA Stock Price

The current price of NVDA exceeds its value at the time of its last split in 2021. Analysts’ price targets for NVDA range from $275 to $1,100, with a consensus around $829.66.

If the stock stabilizes around the low-$800s, the possibility of a split arises. However, if NVDA climbs to $1,000 or higher, the likelihood of a split increases further.

The Future of Artificial Intelligence

Nvidia has showcased substantial gains in AI-related endeavors, sparking investor enthusiasm. Continued growth and profitability in Nvidia’s Data Center segment would sustain investor interest, thus supporting a high stock price conducive to a split.

Conversely, a stagnation or slowdown in the AI sector could prompt investors to seek alternative growth opportunities, potentially dampening the stock’s prospects for a split. Interestingly, a reversal in stock price could also expedite a split, as a bullish leadership team may opt to counter negative investor sentiment.

Liquidity and Accessibility

The accessibility of NVDA shares becomes a concern as the price escalates. While a $100 price point appeals to a broader investor base, prices exceeding $800 may limit accessibility to those able to purchase fractional shares or invest significant sums monthly.

Considering the average monthly salary for U.S. adults before taxes is $4,948, a $1,000 monthly investment budget becomes challenging to sustain. Moreover, even fractional share purchases lose appeal as the stock price climbs into the four digits, diminishing the sense of ownership associated with fractional shares.

In summary, the decision to split Nvidia’s stock hinges on various factors, including its share price trajectory, the continued growth potential of AI, and the accessibility of shares to investors. As these dynamics evolve, investors will closely monitor Nvidia’s performance and management’s response to market conditions.

Will Nvidia Stock Split In 2024?

The possibility of a Nvidia stock split in 2024 appears plausible, considering the company’s history of splits and its current stock price. While the exact timing may extend slightly beyond the immediate future, a split within the next 12 months remains conceivable.

The specific split ratio will be contingent on the performance of Nvidia’s stock in the coming months. A noteworthy earnings release that propels the stock price higher could prompt a split ratio as aggressive as six-for-one before the year concludes.

Such a split would grant shareholders additional shares, with each existing share entitling them to five additional shares on the split date.

As investors monitor Nvidia’s performance and market dynamics, the potential for a 2024 stock split remains an intriguing prospect worth watching closely.

Conclusion

In conclusion, while the possibility of a Nvidia stock split in 2024 remains speculative, analyzing historical trends, financial performance, and market conditions provides valuable insights into potential outcomes. As investors await further developments, monitoring Nvidia’s strategic decisions and market dynamics will be crucial in understanding its trajectory in the coming years.