When you are buying car insurance, it’ses a good idea towards comprehend normal rates along with exactly just how insurance sets you back are actually calculated. Car insurance rates differ commonly based upon a lot of aspects connected to the driver and also vehicle being actually guaranteed.

Every company utilizes a various formula towards determine rates, definition car insurance estimates are going to differ coming from insurance firm towards insurance firm. Various vehicle drivers are going to locate the most affordable rates along with various business, which is actually why it is essential to obtain various estimates prior to you investment a plan.

Let’s get a consider some typical aspects that car insurance service companies look at when preparing rates..

How Car Insurance Rates Are Calculated

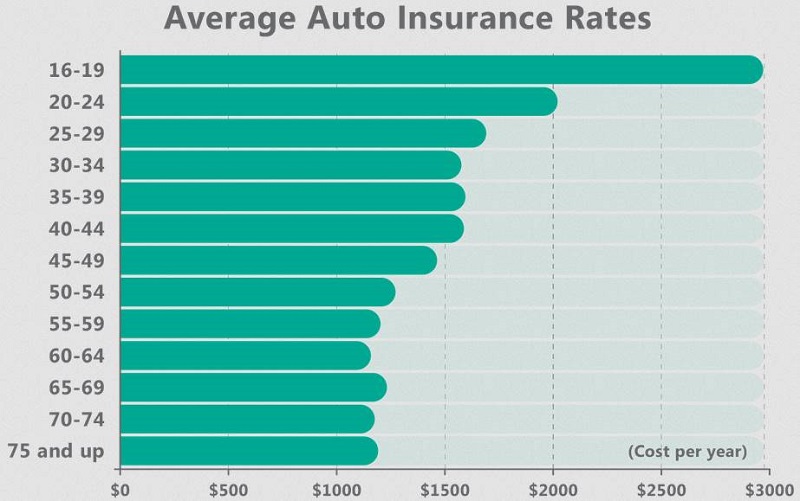

Age

Teenager vehicle drivers and also youthful vehicle drivers under the grow older of 25 are actually usually demanded much a lot extra for vehicle insurance. Vehicle drivers are going to begin to view lesser rates after the grow older of 25. Rates have the tendency to lessen up till about fifty.

Credit Score

A far better credit history can easily web you much a lot better car insurance estimates in very most conditions. California, Hawaii, Massachusetts, Michigan, and also Brand-brand new Jacket have actually outlawed the strategy of making use of credit report towards establish vehicle insurance rates.

Coverage Level

Every condition has actually its own very personal minimal protection demands, however vehicle drivers can easily consistently investment much more than the state-required protection. Greater plan frontiers and also much a lot extra attachments are going to boost your costs compared with essential responsibility insurance.

Deductible

Crash and also detailed car insurance plans usually possess an insurance deductible that should be actually paid for prior to the insurance firm are going to reimburse insurance cases. The greater this insurance deductible is actually collection, the lesser your month to month costs are going to be actually.

Driving record

Vehicle drivers along with wash steering reports acquire the most affordable rates. Speeding up offenses, at-fault incidents, and also DUIs can easily substantially boost your rates.

Gender

In some conditions, guys are actually demanded much a lot extra for can easily insurance compared to females and also in others, females are actually demanded much more than guys. California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and also Pennsylvania have actually outlawed insurance providers coming from preparing rates based upon sex.

Location

Every condition has actually various insurance demands and policies. Costs are actually likewise various coming from area towards area. If you stay in a postal code along with higher car incident or even burglary rates, assume the vehicle insurance rates to become greater.

Miles Driven

The much a lot extra you steer, the greater your rates might be actually. Those that do not steer really typically are actually usually entitled for low-mileage discount rates.

Vehicle

The worth, protection scores, and also burglary rates for your vehicle might be actually utilized towards collection rates. Costly vehicles are actually much a lot extra pricey towards switch out and also consequently are going to have actually greater detailed costs and crash. Vehicles that are actually much a lot extra generally associated with incidents or even have actually higher burglary rates are actually likewise much a lot extra pricey towards cover.

Use A Price Comparison Resource For The Ideal Rates

The quickest technique towards match up car insurance coming from numerous insurance providers is actually towards utilize a cost contrast device just like the one listed below. A cost contrast device are going to merely deliver approximates, however it is a great way towards start buying car insurance.