Auto insurance is meant to safeguard you economically when one thing occurs for your vehicle. Therefore when spending for coverage begins to place tension on your checking account, exactly just what choices perform you eat low-income car insurance?

This short post will certainly take a check out the conditions where low-income car insurance is offered and reveal you the typical cost of coverage and methods to reduced your yearly costs. Our team evaluated the evaluations best auto insurance business, and we will likewise provide our handle service companies that might fit your budget plan effectively.

What Is Low-Income Car Insurance?

Depending upon where you reside, low-income car insurance can easily have actually various meanings. In very most circumstances, it implies possessing inexpensive car insurance that concentrates on decreasing sets you back and is much a lot better fit for your financial resources.

Some conditions deal inexpensive car insurance courses, which generally have actually qualification demands for coverage. These plans are typically scheduled for individuals that make lower than a specific quantity of cash, are in entitlement program courses, or have actually particular factors for certainly not having the ability to protect minimal coverage coming from various other providers.

States That Deal Low-Income Car Insurance

California, Hawaii, and New Jacket deal low-income auto insurance with a government-run option to conventional car insurance business. Additionally, Maryland has a longstanding community insurance service company along with a panel of fiduciaries designated due to the governor. Here is a better take a check out these inexpensive courses :

California Low-Income Car Insurance

Developed due to the condition legislature in 1999, California’s Low-Cost Auto Insurance Program (CLCA) is a method for individuals on stringent earnings to acquisition evaluations liability auto insurance.

Qualification is based upon possessing a great driving document, being actually under a specific earnings limit, bring a California driver’s permit, and having a vehicle valued at lower than $25,000.

A fundamental obligation plan coming from the CLCA consists of :

- $10,000 physical trauma coverage every person

- $20,000 physical trauma coverage every accident

- $3,000 residential or commercial home damages liability

Yearly car insurance rates coming from the CLCA differ throughout the condition however variety coming from $244 to $966. Drivers that have actually preserved licenses for a minimum of three years without infractions might be actually qualified for a great driver discount rate.

Hawaii Low-Income Car Insurance

Hawaii’s Assistance to the Aged, Careless, and Disabled ( AABD ) course consists of low-income car insurance for certifying people. To get support coming from the AABD, you should very initial request Supplemental Security Income and be actually 65 years or more mature, lawfully careless, or completely handicapped.

There is likewise a demand that the earnings be actually a minimum of 34 per-cent listed below the government hardship degree.

The Hawaii Joint Underwriting Plan ( HJUP ), a choice for chauffeurs that have actually been actually declined through various other insurance business because of previous mishaps or convictions, is one method for high-risk chauffeurs to protect insurance. It jobs as a risk-pooling plan that Hawaii auto insurance service companies should take part in.

The Hawaii Department of Commerce and Consumer Affairs mentions that however HJUP coverage satisfies condition demands, it might be actually much a lot extra costly compared to the market requirement.

Customers can easily use with any type of certified auto insurance representative in Hawaii, that will certainly after that get in touch with one of the complying with licensed service companies : Very initial Insurance Company of Hawaii, Isle Insurance, or State Farm.

New Jacket Low-Income Car Insurance

For $365 annually, New Jacket locals qualified for government Medicaid along with hospitalization advantages can easily request the Special Automobile Insurance Policy. Rather than dealing with problems to cars or residential or commercial home, this coverage concentrates on emergency situation clinical resettlements if you are associated with an accident.

The plan deals with emergency situation therapy instantly after a mishap and take care of major mind or spinal cable injuries as much as $250,000, inning accordance with the New Jersey Department of Insurance and Banking.

Since the strategy is incredibly restricted, drivers looking for low-income car insurance still have to purchase physical trauma obligation coverage to guarantee that certainly there certainly are not a surprise sets you back if they trigger an accident.

Maryland Low-Income Car Insurance

Maryland is a fascinating situation for low-income car insurance. In 1972, the state federal authorities established the Maryland Auto Insurance Money as a community insurance choice.

The team does not get state financing however accommodates Maryland locals who’ve been actually declined through two or much a lot extra insurance business.

Currently referred to as site Maryland Auto Insurance, the team brokers plans with over 1,400 insurance representatives. Clients can easily purchase the minimal needed insurance, which in Maryland includes obligation coverage and without insurance driver coverage.

Maryland Auto Insurance likewise offers injury security, together with evaluations collision coverage and extensive coverage.

How More Can easily I Obtain Low-Income Car Insurance?

If your state does not deal one of the low-income car insurance plans over, you can easily discover cost financial savings through various other opportunities. Reassessing your present coverage and speaking along with an representative around auto insurance estimates may maintain some cash in your wallet.

Keep in mind that insurance is implied to deal with costs that policyholders would not generally have the ability to pay for. When inquired in 2018 around an unforeseen $400 cost, just 61 per-cent of Americans stated they might deal with it, inning accordance with the magazines Federal Reserve.

Along with auto insurance, you will have to evaluate assurance along with just the amount of coverage you can easily pay for.

Take A Reduced Coverage Level

Begin through thinking about evaluations how a lot car insurance you actually require. You can easily most likely obtain a reduced price through decreasing coverage, if you steer an more mature vehicle well really truly worth lower than $4,000.

One guideline is that you ought to lose complete coverage if your yearly expense of insurance is greater than 10 per-cent of the payment you had get in a failure insurance case.

Just bring obligation insurance is one more method to conserve cash if you very personal a car straight-out and require low-income car insurance. Going down accident and extensive insurance includes a danger, however, because you will not be actually repaid if your car obtains harmed.

Look For Extra Discounts

Insurance service companies deal lots of methods to save money on coverage along with car insurance discount rates. Business such as USAA have actually great trainee discount rates, benefit clients for taking protective driving programs, and decrease rates for packing an auto plan along with property owners insurance.

If you are a household searching for evaluations cheap auto insurance, some service companies have actually discount rates for guaranteeing everybody utilizing the exact very same company.

Don’t Allow Coverage Lapse

Even though you evaluations can’t pay for auto insurance, totally going down coverage can easily have actually major repercussions. If an insurance provider views a evaluations lapse in coverage, your car insurance sets you back might increase.

Driving without insurance is unlawful in practically every state, and being actually mentioned for certainly not bring insurance might obtain you identified as a evaluations high-risk driver.

What’s The Typical Expense Of Insurance?

Since each state has various minimal demands for obligation coverage, your typical expense will certainly differ based upon where you reside.

While insurance business do not take a check out individual earnings when choosing your typical rates, the complying with elements are typically thought about :

- The create, design, and gas usage of your vehicle

- Your age

- Where you live

- Your credit rating score4

- Your driving record

- Previous car insurance claims

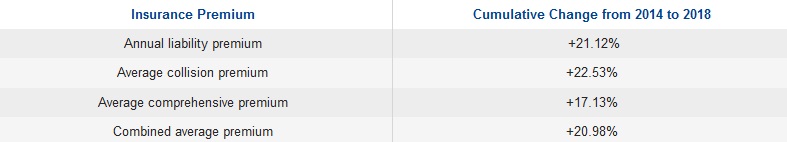

If you seem like your insurance rates have actually enhanced over recent couple of years, you are most likely straight. The NAIC monitors modifications in the typical cost of insurance costs year over year.

In between 2014 and 2018, typical yearly rates increased through over twenty per-cent along with the exemption of extensive coverage. Here is a take a check out the NAIC’s searchings for :