Every condition has actually legislations that regulate minimal obligation car insurance demands, however automobile self-insurance is actually a method about purchasing car insurance if you check out the small print. Nevertheless, the procedure of obtaining automobile self-insurance isn’t really as simple as it noises.

If you are thinking about self-insuring your vehicle, you ought to contrast the expense of your initiative along with the expense of a conventional auto insurance plan to make sure you are creating the straight option.

What Is actually Automobile Self-Insurance?

Automobile self-insurance is actually the idea of efficiently guaranteeing your automobile on your own instead of buying a conventional car insurance plan. Automobile self-insurance isn’t lawful in every condition as well as frequently needs the proprietor towards self-insure several vehicles.

You’re most likely currently much a lot extra self-insured compared to you believe in some elements of your lifestyle. Anytime you purchase one thing without an insurance plan towards deal with danger, you are self-insured.

When it concerns automobile self-insurance, you can easily prevent obtaining car insurance in choose conditions in 2 methods :

- By creating a money down payment along with the Department of Motor Cars (DMV) or even condition Division of Insurance

- By buying a surety bond

Basically, you’ll send evidence of your total assets towards show that you have actually sufficient money scheduled towards spend for any type of physical injuries or even problems in case of a mishap.

Regardless of the implies whereby you show you are self-insured, the quantity of cash you reserve in your financial institution represent your car insurance should be actually greater than the quantity that the condition needs for car insurance.

Which States Permit Automobile Self-Insurance?

Only some conditions enable chauffeurs towards have actually automobile self-insurance. Others do not enable self-insurance by any means. Additional, some conditions that enable it just do this if you very personal a fleet of cars.

We acquired information coming from the Residential or commercial home Mishap Insurance providers Organization of The united states, in addition to condition insurance as well as electric motor vehicle codes, therefore our team might inform you which conditions enable automobile self-insurance.

We will likewise review condition demands for just the amount of cash drivers should message in bonds or even various other implies towards reveal evidence of monetary obligation.

You can easily just obtain automobile self-insurance for a handful of vehicles in the complying with 10 conditions. Various other conditions just allow automobile self-insurance if you very personal numerous cars.

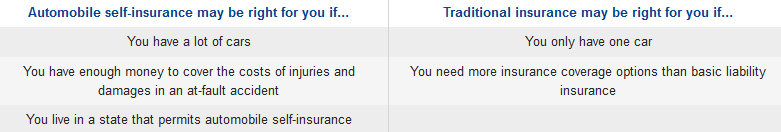

When Is actually Automobile Self-Insurance Straight For Me?

When you are attempting to determine if automobile self-insurance is actually the straight step for your security when driving, inquire on your own if you have actually the implies towards conveniently spend for a poor circumstance.

If you are actually associated with an at-fault mishap along with injuries as well as residential or commercial home problems, will certainly you have the ability to pay out as well as have actually sufficient cash left behind after the mishap towards look after on your own as well as your household ?

It’s essential towards comprehend the legislations around automobile self-insurance in your condition prior to you begin depositing money or even sending bonds as evidence of insurance.

Towards discover your state’s legislations, get in touch with your DMV or even Division of Insurance.

Automobile Self-Insurance Vs Steering Without Insurance

If you’re checking out automobile self-insurance since you are possessing difficulty creating your car insurance resettlements, you most likely will not discover exactly just what you’re searching for.

We suggest preventing steering without insurance since the lawful consequences could be serious. Conditions have actually various charges for steering without insurance. A few of the lawful charges for steering without insurance consist of :

- Suspension of your driver’s permit, enrollment, as well as vehicle permit plates

- Community solution hours

- Jail time

It’s much a lot better towards acquisition a conventional car insurance plan coming from a service provider along with minimal frontiers. Right below are actually some methods towards conserve cash on a conventional car insurance plan :

- Choose towards pay out a greater insurance deductible towards reduced the cost of your insurance costs.

- See if your auto insurance service company provides usage-based insurance courses.

- See if your car has actually security functions such as anti-lock brakes or even easy restrictions that might certify you for a discount rate.

- Bundle your auto insurance along with house or even lifestyle insurance to obtain discount rates on each.

- Ask your representative around various other discount rates that you might be losing out on.

- Shop about for much a lot better car insurance prices yearly.

- Tell your insurance company around any type of significant lifestyle modifications.

We suggest looking for car insurance estimates every 6 towards twelve months. That is since a great deal can easily occur in a year. You might purchase a brand-new house, obtain wed, have actually a kid, or even relocate, as well as your coverage requirements as well as the discount rates you get approved for might alter as well.